Download our Investment Philosophy, Process & Policies.

Our investment philosophy is simple:

Changes in human behavior drive long-term opportunity.

Traditional portfolio management focuses on the growth, value, or quality dimensions of equity market investments. These approaches can founder whenever there is a major change in the marketplace.

Our philosophy transcends the traditional approaches by recognizing how investors typically respond to change through the mental construct of an investment theme. Themes are categories, the mental boxes which organize our understanding of the world.

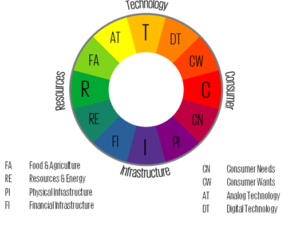

Thematic Elements

The recurring entrepreneurial cycle of economic disruption and renewal continually creates new product and service categories.

However, the basics of human nature do not change very much over centuries.

We have wants, needs, hopes and desires, plus our dependence on the natural world and technology.

From a psychological perspective, the economy is constantly adapting to serve a few basic consumer needs and wants, using inputs from the world of natural resources. These are transformed in ever more ingenious ways through the productivity enablers like technology and the manifold varieties of infrastructure that connect, house and finance businesses and their customers,

Thematic Sectors

This system of demand elements is robust enough to remain applicable over centuries of change.

However, as society develops, and our technology becomes more sophisticated, it is necessary to subdivide the categories further.

Our investment process is driven by the constant refinement of these categories to track new products and services. For instance, Generative AI is now an entirely new subcategory of technology, and Critical Minerals a new category of resources.

Human beings reason about the world in categories, and our process continually refines these to reflect a changing world.

This contrasts with traditional investment management, which employs static sectors and sub-sectors.

Our central belief is that markets are often slow to discount new categories of products and services.

Those who consciously reorganize their thinking to reflect change will come out ahead.

OUR INSPIRATION

Our firm is inspired by the fine example of William Stanley Jevons (1835-1882) and the simple dictum:

Curiosity finds Opportunity.

Jevons is famous for his contributions to economics and the theory of marginal utility.

OUR PRINCIPLES

These eight principles guide our thinking.

Optimism – is the fuel that drives human achievement

Humility – is the protector of every successful investor

Competition – is our best friend and our greatest teacher

Persistence – drives success in all human endeavour

Perspective – is what helps us recognise our errors

Culture – is the glue that binds a team together

Simplicity – is the surest way to mitigate risk

Courage – is essential to have conviction

Fiduciary duty to clients guides our actions.